A specific, real-world competitive product comparison and normalization exercise using our product normalization model

August 2022

Author: Bryan Belanger

August 2022

Author: Bryan Belanger

Recently, we wrote in detail about how to approach competitive product differences as part of a competitive pricing analysis. This piece covered why normalizing product comparisons is important, how to structure a normalization effort, and what resources to use.

While that article gives you a conceptual framework to start with, sometimes the best way to learn a concept is to see it in action. In this post we apply our product normalization model to a specific, real-world competitive product comparison and normalization exercise.

When I started full-time as a research analyst at Technology Business Research, Inc. in 2010 chat, specifically AOL Instant Messenger (R.I.P.) was one of the primary methods we used to communicate internally. I was familiar with AIM as a youth that grew up in the dawn of the modern internet, but I didn’t realize at the time that messaging software was so integral to running a business.

Fast-forward to 2022 and messaging software is the lifeblood of internal business communications, and in many cases, client communications as well. SaaS communities are being built on top of Slack, and increasingly companies are moving to mostly or completely asynchronous working styles that rely heavily on messaging software, including chat, audio and video messaging.

In this new paradigm, battlelines are being drawn around which messaging platform(s) companies choose to use for their employees. Slack is an obvious first choice, an undeniable disruptor and leader — and the thorn in the side of many an IT manager that has been struck with Slack-led shadow IT. For companies that have standardized on Microsoft or Google for email and productivity software, there is a push to use the messaging capabilities offered by those platforms, particularly if they are part of the budget being spent for those suites.

For these reasons, Slack versus Microsoft and Google productivity suites is a really compelling product and pricing comparison. Microsoft Office 365 is positioning a stack of capabilities against a pure play messaging tool, and frequently losing. Slack has differentiated brand and strong product affinity, but how does the pricing positioning compare to say Microsoft, which offers a completely different set of packaged capabilities? That’s what we’ll explore in the rest of this post.

Our baseline of comparison for this analysis is the premium self-service tier of each company’s product: Microsoft 365 Business Standard versus Slack Business+. As of this writing, both products are priced at $12.50 per user, per month for an annual term.

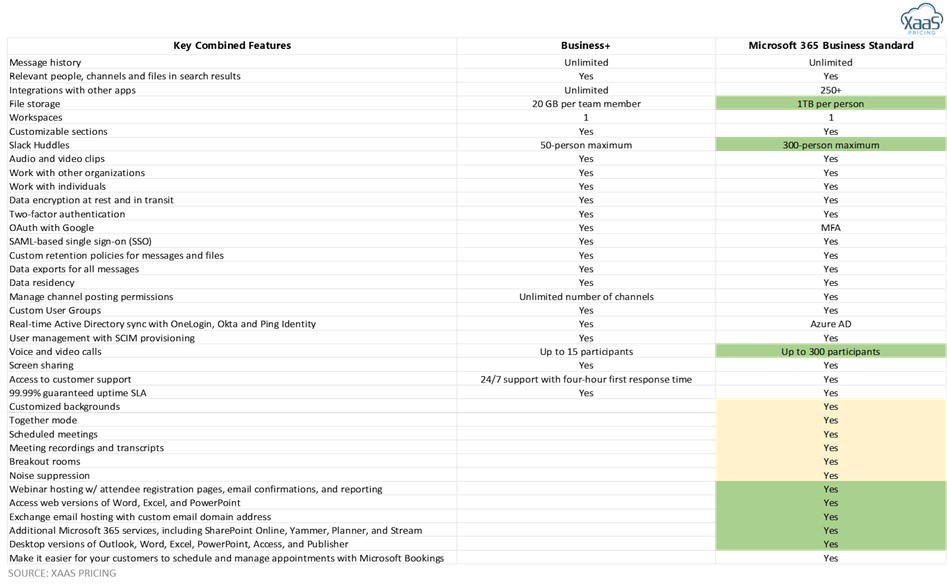

First, we compare the offerings in detail to understand the comparative gaps. Our version of this is outlined in the Excel image below.

To build this comparison, we used each company’s pricing page as well as their related plan documentation for each of the covered products and plans.

We started with compiling all features listed for the Business+ plan on Slack’s pricing page. Then, we endeavored to align available features from Microsoft’s 365 Standard page for Teams. We also listed any additional Microsoft features that we identified.

In the figure above you see our results codified into three categories: (1) no shading means features are the same; (2) yellow shading means features are different, but we don’t believe they have a measurable impact on price; and (3) green shading means features are different, and we believe would have a measurable impact on pricing.

We should note that this comparison was built to be a two-way comparison, but the results show that we uncovered gaps in only Slack as part of our comparison. In most comparisons, there will likely be gaps with both competitors.

This is a bit of a unique case in that it is a true apples-to-oranges comparison (but that’s the point, right?). We should also note that the more detailed you go, the more differences become apparent. There are subcapabilities within each of the above feature categories that may significantly tip the scales one way or the other (keep reading for more details).

The pricing comparison step for the analysis in this post is probably a bit intuitive. It’s clear that there’s a gap here — Slack doesn’t offer office suites or email, which creates a product delta that corresponds to a pricing delta. But that’s also what makes it a clear example for illustrating this product normalization process.

The primary gaps between Slack Business+ and Microsoft 365 Business Standard appear to be:

The next step in this exercise is to solve for these differences by adjusting the price comparison to account for these gaps.

Remember, as we noted earlier, both products are priced at $12.50 per user, per month for an annual term. The idea is to adjust this comparison based on these product gap factors to create a true comparison of cost to the customer at equivalent functionality.

As we move through these comparisons, we’re looking for normalizations at different levels: competitor, market, internal, hybrid.

With this specific example, we’re approaching price normalization from a customer-first perspective — when comparing Slack Business+ to Microsoft 365 Business Standard, we’re asking ourselves, What is the likely set of capabilities a Slack Business+ customer would need to purchase to have the same functionalities as Microsoft 365 Business Standard?

There are many cases where customers are like purchasing Slack on top of a Microsoft 365 plan. Those aren’t our targets for this analysis, as we want to home in on alternatives.

Our bet is that the primary alternative for most customers would be to purchase Slack Business+ and a Google Workspace plan. Based on the Google Workspace packaging, the closest plan providing the storage and participant entitlements of Microsoft 365 Business Standard would be Google Business Standard, which provides 2 TB storage per user and meetings for 150 participants at a price of $12 per user, per month.

We could stop there and assume that we have achieved a baseline comparison, which would make the equivalent bundle of Slack Business+ and Google Business Standard $25 per user, per month, versus Microsoft 365 Standard Business for $12.50. But there is still a gap in webinar support for 300 participants. We could then also assume the Slack Business+ customer would need to purchase Zoom Webinars, which is priced at ~$58 per license, per year for the required amount of participants.

If we were Microsoft, we’d use this type of comparison to position against both Slack and Google. Microsoft is priced for equivalent functionality at the same price as Slack and Google, while a customer of Slack would need both products to compare to Microsoft. Microsoft versus Google would be a different comparison, as Google offers chat capabilities to compete with Microsoft Teams.

The above analysis is helpful for competitive positioning. Again, if we were Microsoft, we’d be arming our sellers with a price-for-value message to sell Teams against Slack.

The reality, however, is that in practice these comparisons need to take in more detailed, contextual factors, which are often derived from deep customer research.

What do we mean? In the comparison of Slack to Microsoft, we identified some clear gaps in the feature set for Slack versus Microsoft. The gaps existing is one thing. The more important thing is how much those gaps matter for each company’s target customers.

Features that show on paper, in many cases, probably make no practical difference to ideal customers. Customers looking at Slack likely have an alternative solution in place for productivity and email. Those customers would thus be disqualified from evaluating Microsoft unless they were willing to consider replacing their current suite (probably Google).

Customers looking at a messaging solution and a productivity suite may not value the additional usage allotted by Microsoft for webinar participants and storage. Perhaps they are a small team that communicates asynchronously, or a development team globally distributed that would never do a webinar. In this case, a higher-end Slack plan such as Business+ coupled with Google’s Business Starter entry-level plan for $6 per user, per month may be enough. These factors would narrow the price gap of the comparison.

All of this is to say, put customers at the center of this type of comparison. Start by defining which ideal customer you are building the analysis for, and then use customer research to understand preferences and tradeoffs as you build the comparison. We made some assumptions on this in our example, but we didn’t field research since we weren’t commissioned to do customer research for Microsoft or Slack. (But if we were doing this for a project or as a member of either vendor’s pricing team, we could. Contact us to find out how we can help you.)

In normalizing product comparisons, you should also consider that premium pricing may be justified and may be a point worth messaging to customers. Circling back to our example, the baseline comparison suggests that Microsoft offers more features and functionality for a lower price than the equivalent Slack solution set. That’s pretty clear. What the analysis hasn’t considered yet is whether customers prefer a discount or premium competitor for this solution category.

If you’re Microsoft, you’re leveraging that positioning and running with it for messaging customers. If you’re Slack, the story is a bit different. This is where, again, it’s important to integrate customer research into these head-to-head comparisons. We don’t have surveys or interviews with Slack and Microsoft customers, but what we do have is comparative data on customer sentiment and features from software review site G2.

G2’s data suggests that Slack outscores Microsoft Teams across just about every category, particularly across key ratings like ease of use, support, quality and related factors. Depending on the customer persona and what they value, this suggests that if you’re Slack, the premium pricing is well justified for the value customers are getting.

Sure, you might be able to get entry-level Teams for $4 per user or a full Office 365 suite with Teams for the same price as Slack. But if your company is serious about needing a messaging solution that supports your whole business, and you’ve committed to asynchronous communication, the value and ease of use for Slack will far outweigh the hard costs and opportunity costs of choosing Teams.

The aforementioned hypothesis is based on G2’s data, not our own, but the point is the same — consider customer perception and value as part of this process. It will help you refine the top-down comparative pricing analysis and contextualize the findings.

©2022 XaaS Pricing. All rights reserved. Terms of Service | Website Maintained by Tidal Media Group

©2022 XaaS Pricing. All rights reserved. Terms of Service | Website Maintained by Tidal Media Group

Macroeconomic uncertainty is prompting pricing-related changes in the XaaS ...

Macroeconomic uncertainty is prompting pricing-related changes in the XaaS ...