Start with a consistent 360-degree framework

Earlier this week we posted about the value of competitive pricing research for “as a Service” companies of all sizes and maturity levels. If you have time, I recommend you go back and read that post before reading this one as they are really two parts of a whole, and that post helps outline many of the concepts we’ll cover more tactically in this one.

Our perspective on competitive pricing research is built around a simple thesis: All companies should use a value-based pricing strategy, but this does not supplant the need for competitive pricing research. In fact, a consistent approach to competitive pricing research can help your company answer questions, save time, and heighten focus on executing your value-based pricing strategy.

At the end of the last post, we share a framework and process for implementing a 360-degree competitive pricing research program that can be used to cover all key elements of a competitor’s pricing strategy. If you already have a competitive pricing research program, great. If not, we recommend using this framework in whole or part, adapting the parts that work for you, to stand up minimum viable research products and processes for tracking competitive pricing strategies for your firm. It will help proactively answer questions, promote self-service competitive insights, and enhance focus on desired pricing strategy outcomes.

Now that have you have the basics in place, zoom in to key focus areas

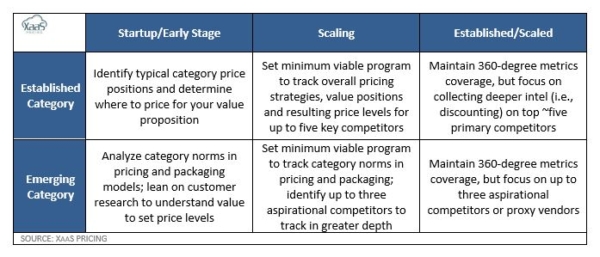

Standing up the type of program mentioned in the previous post isn’t the end state; it’s more like the beginning. Refining the focus of the program to align with your company’s maturity state, goals and market category dynamics is the next step, once you have a solid, repeatable, consistent, results-producing baseline in place.

Focusing on certain elements of competitive pricing strategy doesn’t mean you should deviate from your baseline — otherwise, you’ll find yourself having to chase down unanswered questions from your stakeholders on an ad hoc basis once again. It means you should continue finding ways to refine the program around key focus areas for your business.

You’re probably saying, “OK, we get it. But what should we focus our competitive pricing research program on? Specific competitors? Pricing topics? Both? Something else?”

Those are questions that you’ll ultimately have to answer for yourself. Your competitive situation and your organization’s key pricing strategy goals will require a unique implementation of the approach we’re discussing.

What we can offer are frameworks rooted in lots of research and data to help guide your way.

Case studies in competitive focus: Lessons from two very different SaaS categories

When we started collecting our first data sets for XaaS Pricing, one of the biggest challenges was prioritizing the vendors and the categories we covered. We volleyed the same questions back and forth many times. Should we cover the hottest venture-backed vendors? Should we cover the more established, scaled-stage vendors our clients are asking about? Or should we take a category-by-category approach?

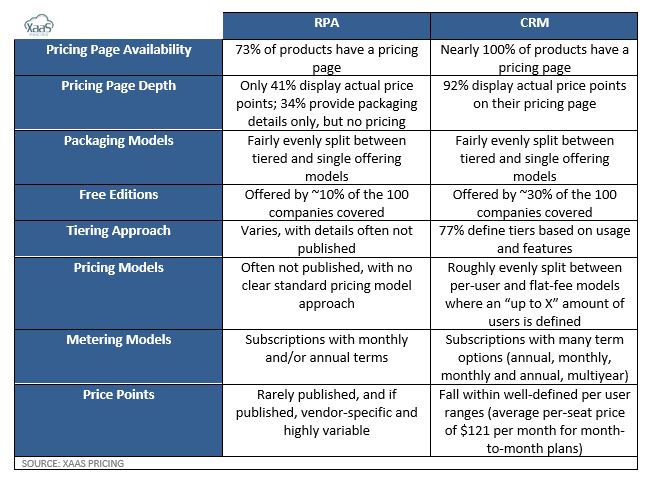

We ultimately landed on a hybrid of the above. For the category-by-category element of our build-out, we decided to create holistic views of two very different categories: robotic process automation (RPA) and CRM. We identified and added XaaS Pricing data on 50 companies within each of these segments. The vendors were chosen based on our research as well as analysis of frequently listed top vendors on industry-leading software review sites.

The list we landed on for this effort:

©2022 XaaS Pricing. All rights reserved.

©2022 XaaS Pricing. All rights reserved.